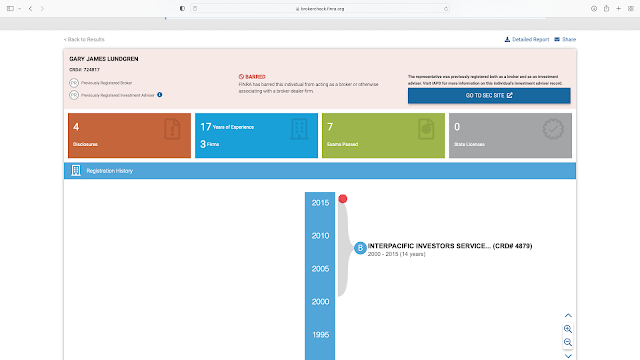

GARY JAMES LUNDGREN, an American who lives in Panama, and who is under a lifetime ban from FINRA on the ability to sell securities, has reportedly retained counsel in the United States, with the goal of having his licenses restored. Given that there are charges pending against Lundgren's adult children in both Argentina and Panama, who act on his behalf in their Panama City offices, we trust that FINRA's capable investigators will see through the charade, and concluding that he is illegally continually selling securities to American citizens and residents, will advise that his petition for relief should be denied, with prejudice.

Lundgren's licenses were cancelled after he repeatedly failed to make the books and records of his business available to FINRA investigators. As we reported on this blog, he allegedly laundered Colombian narcotics profits through his business for decades. After he declined to be transparent about his securities business, FINRA permanently barred him from conducting securities sales for life. Our articles about his activities in Panama, and in the United States were briefly mentioned by the agency, in the decision, including his sales to American investors after he lost his licenses to sell stocks to them.

We also understand that he is blaming this blogger, and a financial crime analyst, Monte Friesner, who also exposed his allegedly illegal business activities. We stand by our articles, and offer to assist any American regulatory agency with our evidence, and if necessary, testimony, to insure that this individual, who presents a Clear and Present Danger to American investors, continue to be barred from doing any securities business in the United States.

FINRA FINAL RULING

Because Lundgren did not provide the information and documents requested in the May and June 2015 FINRA Rule 8210 letters, FINRA issued Lundgren a Notice of Suspension letter dated July 17, 2015. Lundgren timely requested a hearing on August 7, 2015, thereby staying his suspension. Pursuant to FINRA Rule 9559(q), a review subcommittee for the National Adjudicatory Council (NAC) called the matter for review on January 5, 2016. It was concluded that Lundgren's defenses do not excuse his failure to comply with the May and June 2015 FINRA Rule 8210 requests and that Lundgren violated FINRA Rule 8210 by not producing the information and documents sought by the FINRA staff in the May and June 2015 FINRA Rule 8210 requests. Lundgren is suspended from associating with any FINRA member firm in any capacity for failing to provide information and documents pursuant to FINRA Rule 8210. The suspension shall take effect on February 18, 2016. The suspension shall automatically convert to a bar if Lundgren does not comply fully with the May and June 2015 FINRA Rule 8210 requests within 10 days after the date of this decision. The bar is in effect on February 29, 2016. (Associated case #FPI150009) .

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.