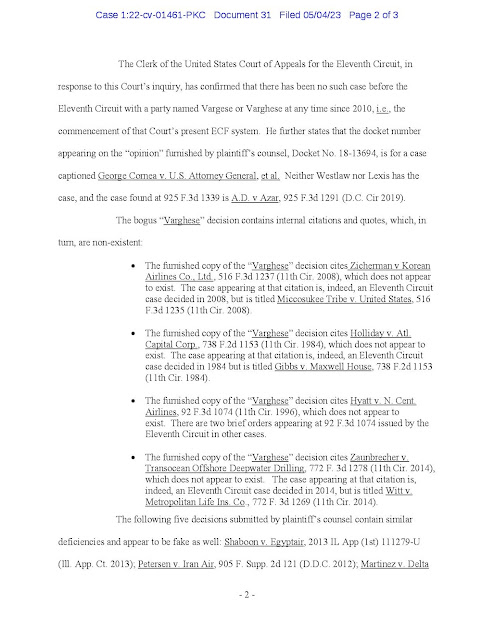

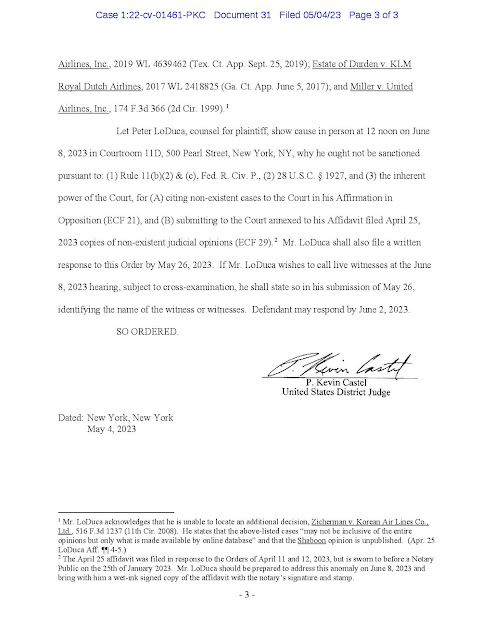

There are multiple reports from Germany regarding fraudulent efforts by individuals concerning the recovery of German External Loan 1924 (Reichmacher) Bonds, which were stolen by Hungarian Arrow Cross (Nazi) officials in 1944 and 1945, when the true owners, Hungarian Jews, were sent to Dachau concentration camp and killed during the Holocaust. Most of Hungary's Jewish population was exterminated at the end of the war, and their assets looted from the two Jewish-owned banks, including bonds originally purchased to aid post-World War One German reconstruction. Many were killed and thrown into the Danube River, and are commemorated by the Shoes Memorial shown below. They were required to remove their shoes before their execution, to be taken by their killers due to wartime shortages.

The government of Germany is now redeeming these bonds for the descendants of the victims of the Holocaust, for a three year period, under the authority of the International Holocaust Recovery Agency, but there have been claims made by individuals who are believed to be descended from the Iron Cross members who took them nearly eighty years ago. These claims have no legal basis, but a number of companies, which exist to assist victims' heirs in application for redemption, have been attempting to cash in bonds for unqualified individuals linked to the Hungarian Nazis that obtained them during World War Two, by sending the owners to their death, either in Dachau or by execution in Hungary.

There is a significant amount of neo-Nazi membership in Hungary, which is reportedly supported by elements of the country's far right government, at the highest level, and members of the Cabinet are alleged to be involved in the fraudulent efforts to cash in millions of dollars in securities, which were underwritten by Bankers Trust Company of the United States. The successor to Bankers Trust is Deutsche Bank.

There are allegations regarding the involvement of INFORMACIOS HIVATAL, Hungary's intelligence agency, and of several sitting ministers of the government, in the efforts to collect on bonds, whose very possession for 80 years may incriminate the holders, as the theft of the bonds occurred in connection with War Crimes and Crimes Against Humanity. We shall be covering this matter in detail in subsequent articles, including the identification of individuals who we have found to be directly involved in fraudulent application for redemption, and their supporters and facilitators in Hungarian financial institutions, which willingly stored boxes of these stolen bonds for the war criminals who took them, and their descendants.

|

| The Bronze Shoes memorial on the Danube, Budapest |

-page-001.jpg)

-page-002.jpg)

-page-003.jpg)

-page-004.jpg)

-page-005.jpg)

-page-006.jpg)

-page-007.jpg)

-page-008.jpg)

-page-009.jpg)

-page-010.jpg)