Saturday, December 31, 2022

NOTE TO COMPLIANCE OFFICERS; WATCH OUT FOR PRO-RUSSIAN AND PRO-CHINA PROPAGANDA ON LINKEDIN

There has been some very clever propaganda appearing on LinkedIn of late; pro-Russian, pro-Chinese, anti-US, and pro-conspiracy articles, disguised as news stories. Do NOT be fooled; someone is up to mischief, and you do not want to take any of that information as true and accurate. Remember, newly-appearing websites,with no history and independent news sources, are most likely disinformation and misinformation; Do not rely upon them. For due diligence purposes, only use sources you know and trust for being objective and factual.

SSSSS

Friday, December 30, 2022

WHEN ADDING NEXT-GENERATION AML/CFT, COMPLIANCE OFFICERS SHOULD CONSIDER THOSE DETAILS TO BE RESTRICTED

|

| Sign on commo equipment, 4th infantry Division, Vietnam |

Before I attended law school, I served a tour with an armored cavalry unit in the First Infantry Division, during the conflict in Vietnam in the 1960s. Communications security during a time of war is critical, lest your enemy learn your plans, and devise an appropriate response in advance, which can cost your side dearly.

On our military radios, most of us had a small sticker, which read Charlie is Listening, located where it could not be missed by whoever was operating that device. Charlie was of course Victor Charlie, the military alphabet designated for the Viet Cong, the VC, our adversaries, whose guerrilla warfare tactics we might today call asymmetric warfare.

The point of this article is to inform you that, when you acquire that next-generation AML platform, do NOT rush out a detailed press release bragging about it, because money launderers read PR websites too.

They also have the latest technology, because their budgets are far larger than yours at the bank, and they are often ahead of what is commercially available, as are their clients. When I was engaged in laundering narcotics profits for American, Canadian and European traffickers, I knew that they had been using email back before it was generally in regular use. They also were the first to use personal computers to store data about their operations, and went paperless years before that was a common. event.

Don't give your opponents any useful information about what software and AI platforms you are using to catch them. Let them think you are still running that old legacy system, so that they don't change what they have been doing in the past, do you can catch therm in the act.

If your provider must publish details of your acquisition of a program employing artificial intelligence, as I trust you will be buying in 2023, if you do not already have such a system, have the company's press release show you as a prominent international bank with a global reach, and not identify you by name. Remember that many money launderers are former bank lawyers and accountants; they know how compliance operates. Just don't give up anything confidential about how you are conducting your anti-money laundering and counter-terrorist financing operations, lest they act accordingly.

Remember, money launderers might adapt, and overcome obstacles you have placed in their way, if they knowing what you are doing. Don't make it easy on them.

|

| Captured VC radio; note red sticker at bottom |

READ THE LETTER THAT INDICTED BVI PREMIER USED IN A FAILED ATTEMPT TO EVADE JUSTICE IN MONEY LAUNDERING AND NARCOTICS TRAFFICKING CASE IN MIAMI

Thursday, December 29, 2022

TWO SENIOR OFFICERS AT MALTA'S FINANCIAL REGULATOR HID PILATUS BANK DOCUMENTS IN SAFE TO KEEP THEM FROM INVESTIGATING MAGISTRATE

Reports from the Republic of Malta confirm that, according to court transcripts, two corrupt officials of the Malta Financial Services Authority (MFSA) hid incriminating financial disclosure documents of the money laundering PILATUS BANK from the investigating magistrate handling the case. The documents contained information detailing Source of Funds for the capitalization of the bank. The arrogance of these two senior officers, who removed and hid evidence, is a breach of their sworn duty to the public, marks them as part of Malta's corrupt government.

The officials, who left the MFSA in 2018 and 2019, have never been held accountable for their crimes.

The two MFSA officials are:

(1) KAROL GABARRETTA, a director in the MFSA Banking Supervision Unit.

|

| Karol Gabarretta |

(2) RAY VELLA, also in the Banking Supervision Unit.

Given the rampant corruption in government agencies in Malta, it is presumed that both individuals, who were the only people with access to the safe where the documents were allegedly stored received substantial illegal compensation, specifically bribes, for their criminal acts. Compliance officers at EU banks must not only consider them to be PEPs, Politically Exposed Persons, but also holders of Proceeds of Crime, and therefore high-risk as potential bank clients, purchasers of businesses or real estate, or for any other legitimate business purpose.

THE USE OF ARTIFICIAL INTELLIGENCE TO DEFEAT MONEY LAUNDERERS' COUNTERMEASURES

Your opponents are familiar with compliance procedures, including the guidelines you follow in assessing whether suspicious transactions, or transactions inconsistent with a client's trade or business are present, and conduct themselves accordingly, so that you do not identify their operations. They engage in countermeasures that defeat your system.

For example, they often spread out their Placement activities among several active but seemingly unrelated accounts in the same bank, because they know that neither your examination nor your software will make the connection. Using traditional and legacy methods, you will not ferret out the well-distributed funds, because they do not follow any semblance of a pattern. Neither your rules-based systems nor your human eye will pick up the pipeline.

Enter the use of a platform employing artificial intelligence with machine learning; it not only finds the opaque relationship between the transactions, it engages in a lookback to extract possibly connected prior transactions, and look forward, observing the latest entires, assembling all of them, past, present and today, into a cohesive result that shows you something that your legacy system ignored, because it doesn't have the ability to develop unrelated data.

The use of AI, in conjunction with experienced staff who know how to read the results, and draw conclusions, can remove the laundrymen's historic advantage over compliance programs that have rules-based limitations. If you have not already upgraded, it's high time to do so, so that you can stop the money launderers exploiting your bank in their tracks.

Wednesday, December 28, 2022

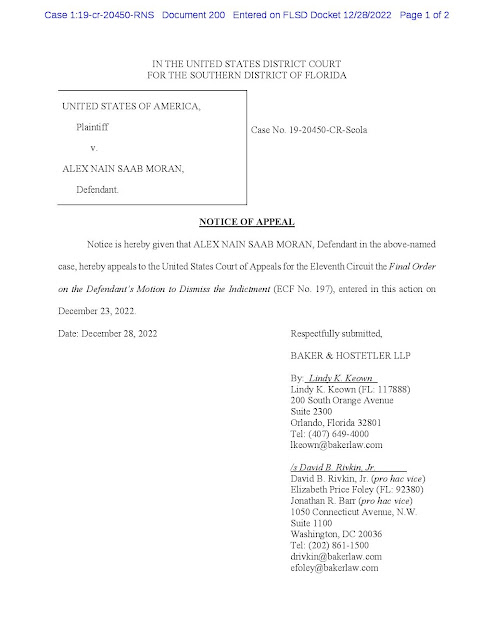

ALEX SAAB MORAN APPEALS DECISION REJECTING HIS MOTION TO DISMISS ON THE GROUNDS OF DIPLOMATIC IMMUNITY

Attorneys for accused Colombian money launderer ALEX NAIN SAAB MORAN today (12/28/22) filed a Notice of Appeal of the Final Order on Defendant's Motion to Dismiss the Indictment, which rejected Saab's position that he had diplomatic immunity, barring him from criminal prosecution. The case will now be heard before the Eleventh Circuit Court of Appeals, which is expected to affirm the District Court holding. This means that Saab's attorneys will be eventually filing a Petition for Certiorari to the United States Supreme Court.

The principal issue is whether Saab Moran is a bona fide diplomat, pursuant to the Vienna Convention on Diplomatic Relations, on the facts of the case. Given the case is considered to be one of great public importance, we believe that the high court will most likely accept jurisdiction, and agree to hear the case; Saab's right of appeal only extends to this 11th Circuit action. The Supreme Court has absolute discretion over whether to take the case.

Irrespective of where the case ends up, a definitive ruling should have a major effect on the ability of International criminals, fraudsters, and purchasers from high-risk countries and State Sponsors of terrorism to utilize diplomatic passports for illicit purposes, especially money laundering. Diplomatic passports acquired in St Kitts & Nevis, Antigua and Barbuda and the Commonwealth of of Dominica have been widely used globally for criminal purposes. Cash buyers who slip money under the table to corrupt Caribbean leaders from these countries to pay for diplomatic passports could find those identity documents worthless when they later seek to evade customs and immigration controls on arrival abroad, in countries of the developing world, should the international principles of the Saab decision be adopted.

USING ARTIFICIAL INTELLIGENCE TO LEVEL THE PLAYING FIELD IN THE FIGHT AGAINST MONEY LAUNDERING

The sad fact is that laundrymen and terrorist financiers are winning the war against money laundering. Having spent a successful decade in that dark profession, I know this to be true. Money launderers, who are not only better funded, they are highly motivated to work nights, weekends and holidays to beat bank compliance departments, and they have been highly successful for the past forty years. Law enforcement agencies will confirm that more than nine out of ten money laundering operations are never uncovered by compliance.

Typically, money launderers locate and exploit new opportunities long before bank compliance officers even learn that they exist, whether that be tradecraft, meaning finding new methods of laundering, or new jurisdictions or entities that can be used to place dirty money. Laundrymen are in and out of a new opportunity long before some database of high-risk entities or individuals lists them, and compliance officers, using traditional search techniques and resources won't tumble to something obscure but effective until much later.

So, what is to be done? Compliance officers cannot solve their dilemma by working harder, but a smarter choice is to employ developing technology to catch the money launderers and terrorist financier in real-time, literally in the act. This means using platforms that are powered by Artificial Intelligence (AI) to find the elusive information that cannot be located by even the most experienced compliance officers, and is them developed using machine learning and analytics to take that data and develop it, displaying connections and relationships that would otherwise never be made.

Compliance officers now have an opportunity to turn the corner on the acquisition of critical information that will make the difference between failure and a successful outcome. the use of AI, and its accompanying programs, will find those heretofore unknown money laundering pipelines, so that they can be identified and terminated, with prejudice. The only thing is, everybody must participate, lest the laundrymen simply relocate to banks and non-bank financial institutions who aren't using these assets.

A compliance officer, using AI-powered systems, can now compete in the Information Age with the money launderers and terrorist financiers; he or she can identify a potential problem, technique or bad actor early on, and change the ultimate outcome, denying their opponents the advantage they have long held. It is a game-changer; let's get it done forthwith.

Tuesday, December 27, 2022

WILL SAAB MORAN DECISION AFFECT THE STATUS OF CARIBBEAN DIPLOMATIC PASSPORTS HELD BY TRANSNATIONAL WHITE COLLAR CRIMINALS?

A U.S. District Judge, in a decision handed down last week in Federal Court in Miami, has held that the claims of diplomatic immunity, made by the Colombian businessman, and accused money launderer, ALEX SAAB MORAN, failed to meet the requirements of the Viennas Convention on Diplomatic Relations, and he cannot be considered a diplomat, with immunity from prosecution. The detailed analysis contained in the decision, rendered as a Final Order on the issues recommended, and can be found, in its entirety, in our recent article Trial Judge holds that Alex Saab Moran has no Diplomatic Immunity from Prosecution in Money Laundering Case .

White-collar criminals, as well as nationals from high risk jurisdictions, and countries designated as state sponsors of terrorism, have been purchasing, for cash (usually US Dollars), diplomatic passports from corrupt government officials in the five East Caribbean states that also sell Citizenship by Investment (CBI) passports, which are:

(A) ST.KITTS AND NEVIS

(B) ANTIGUA AND BARBUDA

(C) COMMONWEALTH OF DOMINICA

(D) ST. LUCIA

(E) GRENADA

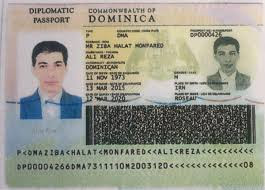

When the Iranian oil sanctions evader and career criminal, ALI REZA MONFARED fled the Far East, having used his Dominica diplomatic passport to avoid arrest by local authorities, he brought with him a suitcase filled with cash, financial instruments and precious gems. That suitcase survived his trip back to Dominica, intact, although it violated the currency controls of the countries he transited, again due to his diplomatic passport purchased in Dominica. Unfortunately, his passport did not protect him from his seizure by Iranian agents in the Dominican Republic. He is now serving 20 years in an Iranian prison, and narrowly avoided the death penalty for corruption.

The holders use the diplomatic passports to avoid customs and immigration upon arrival at airports and seaports around the world, as they generally are allowed to use the VIP-only access, which is there for heads of state and real diplomats in transit or arriving at their duty station. The are not using them for a bona fide diplomatic purpose.

Genuine diplomats satisfy these Vienna Convention requirements:

(1) The individual is appointed to serve at a specific mission abroad. in a specific role.

(2) He or she is generally a national of the country where they are acting as a diplomat.

(3) They present their credentials, upon arrival at their destination country, and are received by the new accepting local government as such.

(4) They are immune from criminal prosecution, within the receiving country only, or while in transit to or from their designated country, and at all points in between, provided that they notify all transit states on their travel route, and such status is accepted by those states.

Unless the "diplomat" has fulfilled these requirements, they cannot be considered a bona fide diplomatic representative for any purpose, including diplomatic immunity. We hope that the authorities in the developing world, who have been accepting these criminals as diplomats without question, now begin to examine their true purpose, and imposing their customs and immigrations regulations upon them. They had best confiscate those bogus diplomatic passports, as they are void for such purposes being used solely for criminal facilitation.

Monday, December 26, 2022

INVESTMENT ADVISOR AND INSURANCE COMPANY OWNER WHO DIVERTED $75m IN COMPLEX FRAUD INVOLVING MALTA ENTITIES ENTERS A PLEA OF GUILTY IN U.S.

Reports have confirmed that CHRISTOPHER HERWIG, an investment advisor and owner of insurance companies another entities, has entered a plea of guilty to Conspiracy, in a complex $75m fraud committed through a Malta company, STANDARD ADVISORY SERVICES LIMITED (SASL) registered with the American Securities & Exchange Commission (SEC). Herwig, and others, skimmed millions from clients through an elaborate scheme employing shell companies and bogus transactions.

A Criminal Information was filed on December 19 against the defendant in US District Court for the Western District of North Carolina, which is generally an indication of cooperation. One of the directors of SASL is prominent American insurance executive GREG LINDBERG, who reportedly owns SASL and a Maltese reinsurance company, STANDARD RE. Both entities are no longer engaged in business, and no longer are licensed.

A Maltese national, JOSEPH GRIOLI, is also reportedly listed as a director of SASL; he is a prominent local Maltese businessman, the owner of a financial services firm, and a director in several companies. Groili has been linked to a number of prominent Maltese government and political figures.

The SEC filed a civil suit in Federal Court, on August 30, 2022 (1:22-cv-00715), against Herwig, Lindberg and SAS, in a 32-page Complaint asking for injunctive relief, disgorgement of illegal profits, and an unspecified civil monetary penalty. A number of other entities are named in that document.

There are reportedly over 100 shell companies linked to the massive fraud. No details have been made public yet regarding the circumstances surrounding precisely how the transactions were structured, and whether bribes or kickbacks were paid, or whether corrupt practices occurred in Malta, or elsewhere abroad. We shall be monitoring both cases, and update our readers on all developments as they occur.

THE USE OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING IN DUE DILIGENCE INVESTIGATIONS

If you are looking to improve the results of your due diligence investigations, platforms that are powered by artificial intelligence, and employ machine learning have been found to be result in a vast improvement to your end product, and result in a report that recovers information that traditional and legacy programs often miss.

The AI sifts through your data sources, collecting relevant information, flagging any potential areas of risk from further consideration, and machine learning adapts to explore all possible avenues, using the results as a springboard. developing additional leads and data sources.

The best due diligence programs supplement the AI and machine learning features with experienced real-life analysts ro review and confirm the results. I note that the latest legal research platforms employ the same value-added method, using seasoned lawyer-researchers to examine the case law found by AI. This is, by far, the best of both worlds, taking the due diligence results your AI program has produced, and having them examined by experienced compliance officers, who can best interpret them.

Considering that traditional due diligence platforms often miss civil litigation on other jurisdictions, negative media published abroad, and regulatory reviews not resulting in action taken, artificial intelligence can ferret out that data. and machine learning can develop those sources to achieve results that you would not otherwise locate.

BVI OFFICIAL WHO CLAIMED THAT PREMIER ANDREW FAHIE HAD BOGUS HEAD OF STATE IMMUNITY FROM US MONEY LAUNDERING CHARGE PLEADS NOT GUILTY

In addition the Saab Moran case, there is another pending matter of great public interest, involving the issue of Immunity from Prosecution.NAJAN CHRISTOPHER, the BVI International Affairs Director, entered a plea of not guilty last week in Roadtown, to charges of Breach of Trust, and False Assumption of Authority, after she sent a bogus "diplomatic note," demanding the release of arrested BVI premier ANDREW FAHIE in the United States, on Money Laundering and drug charges. She has, however, admitted to preparing the relevant document.

Chtistopher's letter, which was written on Premier's Office letterhead, and bore her stamp as director, falsely claimed that Fahie was entitled to Immunity from Prosecution under the internationally-recognized principle of Head of State/Head of Government Immunity. Such a privilege is only available to the leaders of sovereign nations, and not dependent overseas territories, which renders the claim false and verging on fraud upon the court, which in this was the US District Court (SD FL) where Fahie's case is pending.

Whether Fahie personally ordered the letter to be prepared and presented is not known, but allegations of rampant corruption in BVI government have tainted Fahie's administration in the past, and a new unity government is presently in place.

No trial date has been set, but a reporting date on January 12 has been scheduled. The defendant has been ordered to surrender her passport, and is currently out on bail.

Friday, December 23, 2022

TRIAL JUDGE HOLDS THAT ALEX SAAB MORAN HAS NO DIPLOMATIC IMMUNITY FROM PROSECUTION IN MONEY LAUNDERING CASE

|

| Alex Saab Moran, alleged laundryman for Venezuelan President Nicolas Maduro |

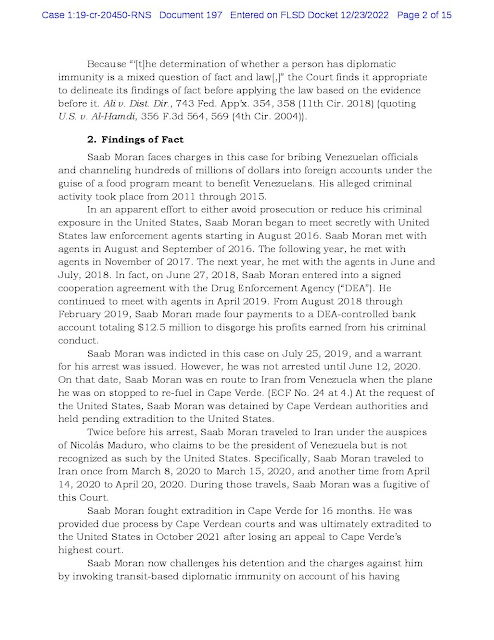

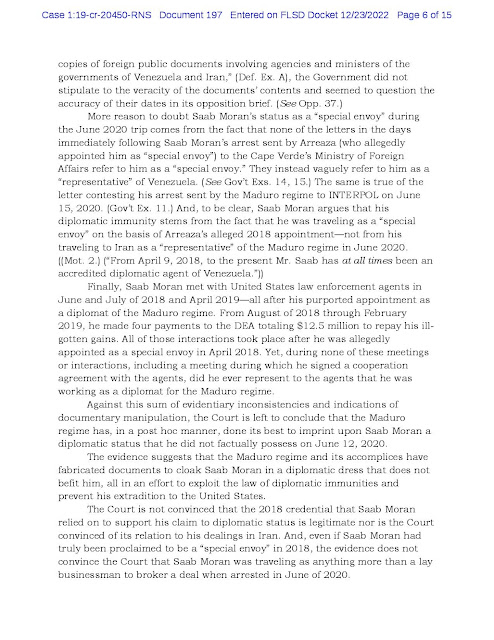

A United States District Judge in Miami has ruled that ALEX NAIN SAAB MORAN, the Colombian businessman who is the alleged money launderer to Venezuela's elite, including its president, cannot have a money laundering case pending against him dismissed, due to diplomatic immunity, which he has claimed after he was detained in Cabo Verde, and extradited to the United States. the decision came after an extensive evidentiary hearing and oral argument of the parties in open court.

The Court held as follows, in a 15-page Final Order on the Defendant's Motion to Dismiss the Indictment:

(1) Saab Moran was NOT a Diplomatic Agent of Venezuela.

(2) He has no diplomatic immunity under the Vienna Convention on Diplomatic Relationships.

(3) He has no immunity under customary international law.

(4) The fact that the United States does not recognize the legitimacy of the current Maduro regime in Venezuela was a factor, as was the fact that expert testimony, given at the evidentiary hearing, showed that official Venezuelan records purporting to show his diplomatic appointment three years ago were deliberately altered and shown as evidence.

The defendant will appeal the decision.

The use of unqualified diplomatic passports, purchased in the developing world by transnational white collar criminals, narcotics traffickers, terrorist financiers, and other career criminals, has become a major issue in recent years, and the United Nations has refused to get involved in declaring that such passports, which violate both the letter and the spirit of the Viennas Convention, void ab initio. The legal authorities contained in this Order could provide useful guidance to courts that face this same issue in the future, not only in the United States, but abroad. Unaccredited "diplomats" with such identity documents can evade customs and immigration, smuggle in financial instruments, for money laundering, with impunity, and commit international fraud at will; this practice must be abolished, before it becomes even more widespread and out of control,

Since this matter is of great public importance, we are attaching the complete text of the fifteen-page decision below:

AMICUS BRIEFS FILED IN HALKBANK U.S. SUPREME COURT CASE SUPPORT GOVERNMENT'S POSITION: FSIA DOES NOT BAR CRIMINAL ACTION AGAINST THE BANK

Two Amicus Curie briefs, filed after the Department of Justice filed its Reply Brief in the Halkbank US Supreme Court case, reinforce the Government's correctness of its position on the law. Clearly, the Foreign Sovereign Immunities Act does not bar a criminal action against Halkbank; legal authorities and precedent cited confirm this principle.

Here are the major points the two briefs make; we are specifically adding this information to our previous articles detailing the opposing views for the benefits of all our readers from Turkey:

1. This Court must defer to the United States' Decision to prosecute crimes, particularly where they implicate our national security and foreign relations.

2.The political branches of government have criminalized terrorism financing and nuclear weapons proliferation and have designated agencies and instrumentalities of Iran.

3. There are important distinctions between a sovereign and its agencies and instrumentalities.

4. The dramatic rise in corporate transnational crimes, state-owned commercial enterprises, and vulnerability off the US financial system to criminal exploitation counsel strongly against weakening the Executive Branch's prosecutorial power.

5. International law in the form of Federal Common Law does not exempt foreign state-owned enterprises from criminal jurisdiction.

6. A company is not a sovereign.

7.There is no Rule of International Law or Federal Common Law barring criminal proceedings against state-owned enterprises.

8. Jurisdictional immunities operate as defenses to jurisdiction, not Ex Ante carve-outs.

9. The FSIA does not deprive the Federal Courts of criminal jurisdiction over foreign state-owned enterprises.

10. the FSIA was enacted to address problems arising from civil litigation.

11. the drafters of the FSIA did not intend to modify title 18 US Code.

12. Halkbank is not a sovereign for any purpose.

Thursday, December 22, 2022

ANXIETY REIGNS IN ANTIGUA AFTER NEWS OF COOPERATING DEFENDANTS IN FTX CASE BREAKS IN NEW YORK

Reliable sources in Antigua & Barbuda report that several prominent individuals, including the country's Prime Minister, Gaston Browne, and bankers and lawyers connected to a local financial institutions that had dealing with the now-defunct cybercurrency giant FTX, all fear that they may be charged in connection with the massive fraud and illegal diversion of assets alleged to have occurred.

Two of the most senior officers of FTX and Alameda have already entered guilty pleas, and begun cooperating with law enforcement, and an additional individual, SBF himself, is now reported to be assisting investigators unravel a complex web of fraud, mismanagement theft on a grand scale, and other offenses which include money laundering and Foreign Corrupt Practices Act violations.

PM Browne, who had a relationship with FTX owner Samuel Bankman-Fried, and who visited SBF in the Bahamas in the company of an unidentified Syrian national, on still unknown business, is said to be especially concerned about being identified as having taken certain action in support of Bankman's operations. FTX was incorporated in Antigua, and though it maintained its principal office in the Bahamas, it had a presence in Antigua's capital. One source has used the term "fear and loathing" to describe the mood inside government circles today.

IS YOUR NEW AFFLUENT LEBANESE CLIENT REALLY A HEZBOLLAH OFFICIAL?

Are you a compliance officer at an EU bank with a number of recent affluent Lebanese "businessmen" as new clients, who deposited large amounts of US Dollars? have you positively verified Source of funds and Source of wealth? If not, you may now be one of Hezbollah's newest unwitting bankers. What is your client's address? Is it in one of the neighborhoods known to be where high-ranking Hezbollah officials reside?

THE FCPA IS NOT ECONOMIC WARFARE AGAINST EUROPE; IT'S SIMPLY JUSTICE

I note that, amongt all the favourable comments surrounding a book condemning the American Foreign Corrupt Practices Act (FCPA) as economic warfare against Europeans, was a comment that my statement supporting the Act as part of the global fight against corruption, was one that accused me of arrogance. The truth is simply this, for our readers in France who have objected to the Act itself:

(1) the Organization for European Cooperation and Development has not only come out with an opinion that the FCPA is NOT economic warfare against Europe, it is strongly supportive of the act. Go on the website if you don't believe me.

(2) Of all the disparaging comments appearing on LinkedIn, I do not see one compliance officer among them. Frontline bankers everywhere, who do not want huge civil fines and penalties, support the Act.

(3) Given that the Act has been given extraterritorial application by US courts, I understand that a lot of people abroad are unhappy about the fact that they might be exposed to American laws. If you commit crimes involving corruption, not only will you be charged with FCPA violations, but as our Money Laundering Control Act of 1986 also has extraterritorial reach, it get worse for you. If you use US dollars, which ultimately confer jurisdiction, or your EU company has branches in the USA, you also risk receiving a 20-year sentence for money laundering, as soon as you deposit or move your bribes or kickbacks through the global financial system.

If the pursuit of justice is arrogant, I plead guilty to your allegation. There has been a special focus on stopping corruption in US foreign policy this year, and it has borne fruit. May it continue, and those in Europe who are oppose it on political grounds are using misplpaced nationalism to shield crime. As we say, patriotism is the last refuge of a scoundrel.

Wednesday, December 21, 2022

HSBC DECLINES TO COMMENT ON MASSIVE REGULATORY FINE, INCLUDING €2m TRANSACTION WITH ZERO COMPLIANCE

WWWWWW

Tuesday, December 20, 2022

BVI PREMIER ANDREW FAHIE'S MONEY LAUNDERING TRIAL RESCHEDULED FOR JULY

US District Judge Kathleen Williams has reset the money laundering and narcotics trafficking trial for former BVI Premier ANDREW FAHIE for July, 2023. The defendant was originally scheduled for January 9. The grounds stated, "Ends of Justice" are a boilerplate statement which sometimes provides a hint that the defendant is seeking to make an arrangement where he will cooperate, in exchange for certain benefits, which usually means dismissal of some of the charges, but we have no confirmation that any plead negotiations are taking place. Hew faces 35 years in Federal Prison, and millions of dollars in potential fines.

The issue of identification of the Cooperating Individual, working with American law enforcement, who offered Fahie money to allow northbound cocaine shipments to be covertly stored in the BVI, and then allowed to transit through British Virgin Islands territorial waters with protection from foreign law maritime force, remains a pending defense motion.

Fahie's cooperation offer, which was rumored to have been the subject of a proffer made early on after his arrest, which was said to include the names of senior government officials in Antigua and Barbuda, and which reportedly caused many sleepless nights in the capitals of the East Caribbean states, out of fear that Fahie would incriminate several leaders, to obtain a sentence including only minimal prison time, and a possible sentence reduction after his testimony at the trials of the corrupt EC leaders that he implicates.

EMPLOYING MACHINE LEARNING IN AN ARTIFICIAL INTELLIGENCE-DRIVEN PLATFORM TO IDENTIFY VIOLATIONS OF THE FOREIGN CORRUPT PRACTICES ACT AND THE BRIBERY ACT

senior government officials through bogus expenses, or to charities, vendors or agents, or painstakingly creating subsequent bogus consultancies, payable after the recipients have left government service, illustrates my point. Often, bankers or investigators come up empty-handed when seeking evidence of corruption. Technology can now assist in the solution to that knotty problem.

Enter machine learning in an AI-powered platform; whereas before the relationship between confusing, disjointed artfully disguised data was never detected, advanced data science techniques, which means Artificial Intelligence and machine learning solutions can extract information from the data, and report anomalies likely to be FCPA or Bribery Act violations.

For further relevant information