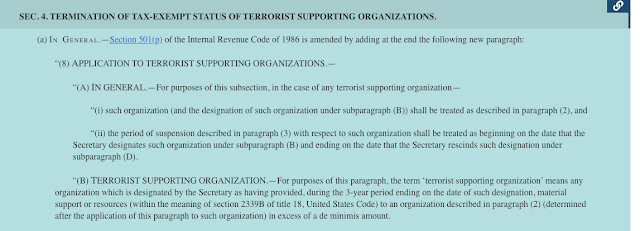

A bill working its way through the US Congress, H.R. 9495, designated the Stop Terror-Financing and Tax Penalties on American Hostages Act, has passed the House of Representatives, and after its anticipated passage by the United States Senate, will most likely become law. It gives the Secretary of the Treasury the ability to designate any non-profit a "Terrorist Supporting Organization," and strip it of its §501 tax-exempt status, under the Internal Revenue Code.

While the new law creates an additional, and sorely needed, tool in the war against terrorist financing, it by definition raises the bar for compliance officers on non-profits and non-governmental organizations that are tax-exempt under the I.R.C., because such a designation, and labeling, by the Secretary may be the first step to sanctions. it also may create a presumption of terrorist financing that could necessitate the immediate closure of accounts by compliance. Regulators may later ask why such accounts were allowed to continue to remain open after such a designation. Law enforcement agencies and the Department of Justice may also question such actions by a bank, and they may be hold by a court of competent jurisdiction to constitute a failure of effective AML/CFT compliance.

Whether this new law, after its passage, will require compliance officers at financial institutions, as well as NBFIs, to monitor all Treasury Terrorist Supporting Organization designations, to insure that their bank clients have not been added to that list, is a real concern. Will the names be added to databases of high-risk individuals and entities, making that information readily available, or must compliance officers themselves make that determination? We cannot say, but how these issues develop will most certainly be a topic of conversation among compliance officers, as well as their legal advisors, in the near future.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.