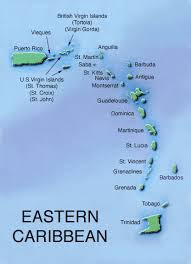

I was asked yesterday, on a program where I was being interviewed on Radio Anguilla, about the origins of the controversial Citizenship by Investment, or CBI, passports & citizenship programs that five of the East Caribbean states, as well as Malta in the EU, and a few others, operate as a means of increasing government revenue for those jurisdictions. You may not be aware of the circumstances, so perhaps it's time for a history lesson, which will give context to the issues I am about to analyze and discuss.

It was 1983, and I was, as a former bank attorney-turned career money launderer for narcotics traffickers moving cocaine and marijuana, in the offshore financial centers of the East Caribbean, plying my dark laundryman trade within the local banks, including one in the British Dependent Territory of Anguilla, and availing myself of the "unusual" legal services of one of the most prominent attorneys in that island, William Herbert, Jr., more commonly known locally as Billy. Dr. Herbert asked me whether any of my clients might be interested in purchasing a newly-unveiled product of neighboring St. Christopher & Nevis, a Citizenship by Investment passport, which came along with all the rights and privileges of citizenship. He would go on to disappear from the face of the earth after being falsely accused of losing or stealing a large amount of money belonging to the Irish Republican Army (IRA), but that's another story not relevant to our topic today (although you can find it here in previously published content on this blog).

t would appear that enterprising UK-trained Kittitian attorneys, when faced with the insufficient revenue needs of a newly-independent republic, and entrusted with creating a legislative solution to their country's cash-flow problem, took the Swiss model of bank secrecy, and added corporation secrecy to the equation. This means that companies could be formed with bearer shares, and criminal penalties were imposed for even making an inquiry about who was the beneficial owner of a corporation, with enhanced fines & imprisonment for law enforcement agent who dared to ask. It was an act which would insure that "flight capital" (dirty money) could be held in local accounts with total and complete anonymity.

I seriously considered taking Doctor Herbert up on his offer. One of my largest drug trafficking clients, the Parisian Georges Krancenblum, returned from a "business trip" to the Republic of Panama with a handful of passport photos appropriate to add to applications I intended to process for CBI passports, some of whom you would know, because they included certain kingpins in the feared Medellin Cartel. Unfortunately for the clients, one of their cocaine-laden vessels was seized shortly thereafter in the Miami River, and they were forced to flee the United States to avoid arrest and indictment.

When I advised Dr, Herbert that my clients most likely were now wanted by the DEA, and knowing that the Cartel leaders were most certainly indicted, his reply was that I somehow obtain an affidavit attesting to their good conduct, rather than letters from local police departments attesting to their lack of any pending criminal charges, which I could no longer do. At that point I understood the reality of the CBI passport scheme; it was purely a method to raise funds, and the fact that the applicants were criminals was not a factor in their approval. Those passport photos, and the unfiled applications promptly were shredded and dropped into my garbage can, which is most likely why I am alive today to tell this story.

|

| Ambassador Herbert |

Now, let's fast forward from 1983 to 2023, where the five East Caribbean states, and Malta, have sold CBI passports, knowingly, to career fraudsters, transnational narcotics kingpins, sanctions evaders, corrupt PEPs, and all sorts of Other Suspects, all for the sake of income into their national treasuries, plus cash bribe payments to facilitate the approval of such high-risk applicants, and the opening of large bank accounts there with the proceeds of crime. Their compliance programs, which are claimed to be effective, are routinely compromised by cash under the table, paid to corrupt government officials. Commission consultants, who rake in obscenely high payments for directing applicants to specific CBI jurisdictions, assist with the approval of clearly unsuitable applicants, and the madness goes on, and on, and on.

The money is far too powerful a corrupting influence for any of these programs to approach a Banking Best Practices compliance level, especially when the cash of these career criminals is promptly deposited in locally-owned financial institutions. It will not clean itself up, and compliance officers must face reality, and treat all the holders of CBI passports as extremely high risk, and bar them as gatekeepers, lest they involve their bank in willful blindness, with the usual negative consequences. Do you redline all CBI passports? Given what you have just read, do you really have a choice? This may hurt those legitimate CBI passport holders, but since you are operating a risk-based AML compliance program, you know the answer.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.