Tuesday, October 31, 2023

ARE WE NOW SEEING EFFECTIVE SENTENCING IN THE UNITED STATES FOR MONEY LAUNDERERS?

This week's financial crime news included a six and one-half year sentence being handed down in a Federal California case, in the Los Angeles area, against ARMAN NIKOGOSYAN, for laundering three million dollars of fraudulently-obtained unemployment benefits obtained during the COVID crisis. The defendant, who has close to $200,000 in cash at his home when arrested, richly deserves that amount of time, but the case raises an important issue: why are many money launderers otherwise receiving short sentences in Federal Court?

I fully understand that many money laundering defendants not only plead guilty, but also assist law enforcement in the prosecution of others, in what we call the rendering of "Substantial Assistance," but in most cases, they are allowed to plead to a SINGLE money laundering conspiracy charge. This does not effectively deter others from engaging in money laundering, in my humble opinion. In fact, it gives individuals who are contemplating criminal action a false sense of security; at worst, they may have to serve two years or less, and if they artfully and carefully hid the proceeds of their crimes, they can come back out of prison and enjoy those illicitly-earned profits.

When I was serving a term in Federal Prison for money laundering, there was another inmate there who had been previously convicted, and incarcerated, under short sentences, six times! What's wrong with that picture? He had never served a sufficiently long sentence to give him pause before jumping right into criminal conduct upon release, several times. These short sentence for money laundering, which is a twenty year felony, must cease to be meted out, if we are to actually practice deterrence.

Perhaps this 6 1/2 sentence is the shape of things to come; if so I welcome it, for what has gone on in the past is not working.

Monday, October 30, 2023

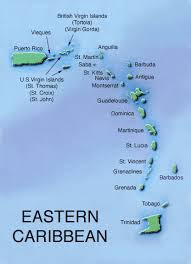

SINGAPORE PUBLISHES ST.KITTS AND DOMINICA CBI PASSPORTS AND PHOTOGRAPHS OF CHINESE MONEY LAUNDERERS WHO USED THEM TO MOVE $2.2bn IN DIRTY MONEY

If you have been reading the news about Singapore's massive multi-billion dollar money laundering scandal, perpetrated by chinese nationals using Citizenship by Investment (CBI) passports bought from St. Kitts and Dominica to clean the proceeds of crimes conducted in the Peoples' Republic of China, and you are sharp, you will have noticed that their SKN and Dominica passports have appeared in the local media reporting on the arrests and seizures of millions in cash and valuables. While the faces were blacked out, the photographs of the offenders appeared elsewhere, leaving no doubt about the fact that these CBI identity documents were the method of choice for these career criminals.

What is amazing is that major international bank branches in Singapore actually accepted these passports as proof of not only identity but of nationality.either the compliance officers at these banks were guilty of compliance malpractice, or the officers received illegal gratuities to pass clearly suspicious transactions. Either way, the frontline compliance staff at these banks, all of which are now under criminal investigation by Singaporean authorities, deserve to be terminated, if not indicted, for any newly minted compliance officer knows that many CBI passports, issued by the five East Caribbean states and the republic of Malta, are employed by white collar criminals engaged in money laundering, financial fraud, and identity manipulation. Who on earth is watching the store at those banks?

Compliance officers pay close attention: if someone hands you a CBI passport from ST.KITTS & NEVIS, DOMINICA, ANTIGUA & BARBUDA, ST. LUCIA, GRENADA or MALTA, conduct enhanced due diligence immediately, unless you want your bank to be named & shamed on the pages of the New York Times. Without exception, ladies and gentlemen.

Sunday, October 29, 2023

BARBADOS MEDIA SELF-CENSORS COVERAGE OF CIVIL RICO SUIT AGAINST 98 PROMINENT LAWYERS ALLEGING MASSIVE ORGANISED PROBATE AND REAL ESTATE FRAUD

Notwithstanding that a major civil RICO action has been filed in the United States, against 98 prominent local Bajan attorneys, alleging that they are operating a unified criminal enterprise designed to deprive individuals in Barbados of their lawful inheritance, there has been no press coverage within Barbados of this important case. Reports that local media has been directly warned not to run any stories on the lawsuit, on pain of suffering specific economic consequences, as well as physical harm, are believed to be the reason for this self-censorship of the news. There appears to be a total news blackout within Barbados, although elsewhere in the East Caribbean, the case has been heard on radio programs based elsewhere.

The lawsuit, which names many senior government officials as present or former participants in the illicit scheme, whereby attorneys handling estates for heirs who have no formal education are deprived of valuable real estate parcels, which are then sold to unsuspecting European hotel and resort developers, includes the sitting Prime Minister, Mia Amor Mottley, as a party defendant, and alleges her involvement.

To date, none of the attorneys, judges, government officials, or retired lawyers have formally appeared in the case, nor have any US lawyers filed notices on their behalf. Whether the defendants intend to default is not known, but there are allegations that they own real estate in Florida, as well as maintain bank accounts there, which is reportedly the grounds for imposing personal jurisdiction upon them. We shall continue to follow and report on all developments as they occur: Stay tuned.

Saturday, October 28, 2023

BE WARY OF THE INTENSIVE SPONSORED MEDIA CAMPAIGN SEEKING TO DISCREDIT WHISTLEBLOWERS CRITICAL OF EAST CARIBBEAN CBI ECONOMIC PASSPORT ISSUERS

|

| The flag of the Commonwealth of Dominica |

Recent articles in mainstream media, as well as whistleblower websites, which have pointed out the fact that many Citizenship by Investment (CBI) issuing jurisdictions have sold economic passports to white collar criminals, international sanctions evaders, and individuals from high-risk jurisdictions, allowing them to alter their identities, and thereafter enter the EU and UK without the necessity of obtaining, and qualify for, visas, have resulted in pushback on the Internet.

The OCCRP in particular has been the target of a major campaign wherein unknown websites are alleging that it receives funding from Russia and Iran. This disinformation, intended to discredit the organization's recent critical articles on Dominica and St. Kitts, appear to have been in response to the OCCRP exposing an Indian national. Compliance officers should always be suspicious of ANY web source not known to them to be an authoritative source for news and information, and never rely upon anything such websites offer the public. We often find such websites are newly created; they claim to merely publish the news, but they are generally found to contain misinformation and propaganda. If you have never heard of them in the past, ignore their bold claims.They are sponsored efforts to deceive you, and discredit the truth.

Here are some of the dangerous websites:

Friday, October 27, 2023

RAISE COUNTRY RISK AFTER SLOVAKIA ELECTS FAR RIGHT PRO-RUSSIAN LEADER, CANCELS MILITARY AID TO UKRAINE

Compliance officers in the European Union should take a hard look at the SLOVAK REPUBLIC, more commonly known as SLOVAKIA, after the country elected a far-right leader, and abruptly cancelled all military aid to the Ukraine. New national leadership, with is openly pro-Russian, and objects to imposing sanctions, could direct its law enforcement agencies to ignore shipments of dual-use products to Russia, close its eyes to the transit of funds violating sanctions against Russia imposed by other EU members, or even facilitate the delivery of military supplies to Russia, either directly, or through Belarus.

|

| ROBERT FICO, new populist PM |

Substantial financial transactions to or from Slovakia, which was previously a strong supporter of the Ukraine in its defensive war against Russia, must now be a subject of concern for compliance officers. While we are not aware of any suspicious transactions being reported by EU Member states, frontline compliance officers tasked with transaction monitoring should be briefed by their compliance supervisors to be alert to any sign of an increase in wire transfers, requests for bulk shipments of US Dollars to Slovakian financial institutions, and other indicia of activity that might indicate covert assistance to Russia and its military-industrial complex.

_____________________________________

NOTE: The book cover seen at the top of this page is "The Laundry Man" published in the Slovak language.

FAILURE TO MAKE REFUNDS BY EAST CARIBBEAN CBI STATES CONFIRMS THEIR GREED AND AVARICE

A large group of participants of the Citizenship by Investment Program by St. Kitts and Nevis, have faced unfair and unlawful actions from the Citizenship by Investment Unit (CIU) between 2022 and 2023. These participants had successfully completed the Due Diligence procedures and transferred their contributions to the state fund, but received letters from CIU stating that CIU would not issue passports. The monies have never been returned. The St. Kitts and Nevis government is unlawfully withholding the refunds.

Their repeated demands for refunds have been singularly ignored by Kittitian authorities, who have published the photograph and identity of the head of the CBI agency, and the Warning Notice appearing above, which cautions future applicants that any payments they make could be arbitrarily converted, without authority, and with no recourse in St. Kitts' courts or administrative proceedings, by local authorities, which could constitute fraud.

This scandal, which has not only affected the reputation of the CBI industry, but worried CBI consultants on a global basis, could result in unhappy applicants bringing civil suits against the major consultancies, who receive obscenely high commissions for steering applicants to specific East Caribbean jurisdictions. It may also result in a diversion of CBI clients, by the consultants, from recommending St. Kitts, and the other four East Caribbean CBI states, for applications, in favor of the sole remaining CBI-issuing jurisdiction within the European Union (EU), the Republic of Malta. CBI consultants are themselves openly concerning about not only their personal liability, but in a major decrease in applications believed to result from this act of St. Kitts, which can only be attributed to abject greed on the part of senior government officials.

We have repeatedly warned our readers for years that CBI passport applicants stand to lose their entire investment for a variety of reasons, and have no legal recourse when that occurs, as local courts in the EC favor government agencies over foreign nationals under most circumstances. "Let the Buyer Beware," SKN national motto: COUNTRY ABOVE SELF, indeed.

Thursday, October 26, 2023

SWITZERLAND SUSPENDS FUNDING TO NGOs LINKED TO HAMAS - SEE LIST BELOW

Switzerland has suspended the funding of all the following NGOs:

Adalah

Al-Shabaka

Gisha

Hamleh

Hamoked

Jerusalem Legal Aid and Human Rights Centre (JLAC)

MIFTAH: The Palestinian Initiative for the Promotion of Global Dialogue and Democracy

Palestinian Center for Human Rights (PCHR)

Palestinian NGO Network (PNGO)

Physicians for Human Rights (PHR)

Women's Centre for Legal Aid and Counselling (WCLAC)

MONEY LAUNDERER ARRESTED IN MASSACHUSETTS CLEANED OVER $20 MILLION THROUGH LOTTERY TICKETS

|

| Ali Jafaar |

Back in the day when, as a practicing money launderer, I was in contact with several Miami drug trafficking organizations, most of whom were clients of mine, one group engaged in laundering their marijuana profits through quiet purchases of winning lottery tickets in Puerto Rico. They were eminently successful in that technique, and the recent major money laundering arrest in Massachusetts, of a laundryman who used that method to clean over twenty million dollars, reminded me of the tradecraft involved.

What my clients did was let the word get out in Puerto Rico that they would pay a premium over the value of any substantial winning lottery tickets, in cash, no questions asked, and then declare themselves the winners, thereby effectively cleaning millions of narco-profits. Yes, of course they would pay all the necessary taxes, because their goal was not to maximize illicit profits, but to legitimize a large portion of it.

Now turn this method on its side. In the Mass. State Lottery case, for a ten percent fee, the laundryman would agree to be the frontman for real winners, redeeming them, and actually filing tax returns on the income, but he would offset that money with bogus and ficticious gambling losses, cancelling out any payment he might have owed. Meanwhile, the real winner got a load of cash that he didn't have to report and pay taxes on to the IRS. It's actually the flip side of the technique.

It is important to know that the authentic winners might have other reasons for not turning in their ticket, besides the tax bite taken out. The IRS can deduct any and all taxes owed from the winner's past tax years, as well as past-due child support, or other delinquent debts owed to Uncle Sam. The laundrymen even went so far as to claim bogus tax refunds, which one does not do if one wishes to avoid being targeted by the Service in a big way. All the participants got prison time; sentences of five years, four years and one month, and six months were meted out to the money launderers involved, who pled to both Filing a False Tax Return and Money Laundering Conspiracy.

Remember, a good money launderer will always take a method used in the past, stand it on its head, and make it work. In that dark world, you are only limited by your imagination. If your perspective on compliance has finite limits, the laundryman will beat you every day of the week. Do not be afraid to consider alternatives to the usual methods and techniques; your opponents do that constantly. Don't let them winn.

Tuesday, October 24, 2023

WILL GOOGLE'S NEW SYSTEM NOW ASSIST MONEY LAUNDERERS, FINANCIAL CRIMINALS AND OTHER HIGH-RISK INDIVIDUALS?

This week's news, to the effect that Google Search will now accept requests by individuals to have their "personal information" deleted from websites that show emails address, telephone numbers and other personal data, is a classic example of the Law of Unintended Consequences. While we certainly understand that legitimate, law-abiding individuals have a desire to have their very personal data, that which can be used not only to to contact them, but to target them for unwanted and repeated commercial solicitations, the delivery of physical threats and unsolicited visits from a wide variety of salesmen, reporters and those with a political axe to grind, there's something much more relevant here for compliance officers. Google Search has noted that it will review such applications, and if granted, delete the relevant information now showing up on Google inquiries of targets. Though the platform is said to only be in the Beta stage, you can expect a final version shortly.

Much of what compliance officers do is, by its very nature, dependent upon open source information to verify data for CIP, update existing files, and to check on unknown non-client counterparties, recipients of funds, references supplied as account opening, and to file SARs ( Suspicious Activity Reports). Of course, let's not forget the individual who shoulders the compliance responsibility at a non-bank, ro non-financial entity, whose idea of due diligence is to search Google quickly, and not finding anything negative, then approves the client.

You'd better believe that many money launderers, as well as their career criminal clients, most of whom have never been arrested, let alone have felony convictions, are already sending in their requests for deletion to Google's administrators. The last thing they want is that you can find that they pushed a sophisticated synthetic identity on you, which you might be able to expose from something about an innocent victim whose personal data reveals their fraud.

We need all the personal data present in the www to remain precisely here it currently resides, lest we give the laundrymen yet another advantage over the world's compliance officers. You may not like to hear this, but there is no personal right of privacy when it trumps AML, in my humble opinion. You are free to disagree until some financial criminal, taking advantage of Google's new "Right to be Left Alone," moves the proceeds of crime through your bank.

Friday, October 20, 2023

HERE'S THE LINK TO SIGN UP FOR "LESSONS FROM A FORMER MONEY LAUNDERER" AT MONEY 20/20 ON OCTOBER 23 IN LAS VEGAS

Lessons from a Former Money Launderer

Monday, October 23 at 12 p.m.

Explore the intricate realm of financial crime through the eyes of Kenneth Rijock, a former money launderer for a number of American and European narcotics traffickers. This informative session will reveal the shadowy world of financial crime, and empower your organization to confidently safeguard against it through radically accurate identity verification and fraud prevention solutions.

COMPLIANCE OFFICERS: LOOK FOR ADDITIONAL PREDICATE ACTS WITHIN YOUR MONEY LAUNDERING INVESTIGATION. YOU WILL FIND THEM

If you read my recent article, How Fraud and Identity Disinformation are both Essential Components in the Money Launderer's Toolbox (October 15, 2023), you know that laundrymen employ well-constructed bogus identities, as well as engaging in fraudulent acts, all in support of their operations, but there's another aspect that frequently goes unnoticed. They often engage in any one of dozens of other crimes that can independently support a money laundering indictment. These are known as Predicate Acts.

The case law defines Predicate Offenses, also known as Predicate Crimes, as acts which are a component of a larger crime. They are part of a larger crime if they have a purpose similar to the larger crime, and you know that there must be a predicate offense underlying any money laundering charge. It is possible that there are several predicate offenses, all of which can support that money laundering charge. They may lead you down a completely different path, if you identify them in your investigation. Use your own software tools to develop the information further.

While compliance officers know that the deposit of the proceeds of crime into a bank account constitutes a criminal offense, they should also look for additional hints of other related crimes when examining transaction records, for they may indeed literally run into the underlying crimes, the profits of which the money launderer is seeking to clean in the first place. Look back into financial transactions before the suspicious ones; is there anything inconsistent with what you know about the ordinary legitimate conduct of that specific trade or industry? If so, inquire further, and broaden your inquiry of transactions to examine who or what the target company does business with. You may uncover a criminal operation far greater than the transactions you found in the first place; Happy hunting.

If you are attending MONEY 20/20 in Las Vegas next week, you are welcome to attend my next presentation, Adopting a Criminal's Mindset to Safeguard Your Business and Minimize Risk, sponsored by Socure. Please reserve your place in advance, as it is a luncheon and seating is limited.

Thursday, October 19, 2023

EU NOTES THAT MANY OF THE 88,000 CBI PASSPORTS ISSUED IN THE EAST CARIBBEAN HAVE NOT BEEN REPORTED, ADVISES IT WILL TERMINATE VISA-FREE ENTRY

Senior officials in the European Union, who have recently learned that more than 88,000 CBI passports have been issued by the five East Caribbean states that offer economic citizenship, and many have not been duly reported. The EU reports that passports equivalent to one half the population of Dominica have been issued by that country, and that most have been sold to citizens of Russia, Iran and China. Dominica knowingly facilitates transnational white collar crime.

Noting that many of these passports are issued under names that are not the legal names of the applicants, and such information as dates and places of birth are also intentionally inaccurate or altered, the EU is moving forward to consider revoking the visa-free access currently allowed to passport holders from St. Kitts, Antigua & Barbuda, Dominica, St. Lucia and Grenada, all CBI-issuing jurisdictions. The Uk has already cancelled visa-free entry for passport holders from Dominica, one of its former colonial possessions, and a member of the Commonwealth of Nations, due to the repeated abuse of the visa exemption by international white collar criminals, sanctions evaders, and organized crime elements, all using Dominican CBI passports. Dominica's ineffective due diligence program for applicants is trumped by corruption and the avarice of its commission-based citizenship consultants.

Any such EU action, which will remove the principal allure CBI passports have for most purchasers, may make those documents an endangered species. It will close a major loophole that grants access to Europe by career criminals and other high-risk individuals, especially money launderers and fraudsters. We wish the EU to act forthwith, as CBI passports in the hands of criminals represent a clear and present money laundering danger to Europe's banks and investment firms.

ARE ANY HAMAS MONEY LAUNDERERS OR COURIERS COMING INTO YOUR BANK TO CLEAN OUT AN ACCOUNT OF ONE OF THEIR DECEASED LEADERS?

SSSSSSSSSS

WILL COMPLIANCE OFFICERS EVER BE ABLE TO TRUST THE HOLDER OF A CBI PASSPORT SEEKING TO OPEN AN ACCOUNT?

I was asked yesterday, on a program where I was being interviewed on Radio Anguilla, about the origins of the controversial Citizenship by Investment, or CBI, passports & citizenship programs that five of the East Caribbean states, as well as Malta in the EU, and a few others, operate as a means of increasing government revenue for those jurisdictions. You may not be aware of the circumstances, so perhaps it's time for a history lesson, which will give context to the issues I am about to analyze and discuss.

It was 1983, and I was, as a former bank attorney-turned career money launderer for narcotics traffickers moving cocaine and marijuana, in the offshore financial centers of the East Caribbean, plying my dark laundryman trade within the local banks, including one in the British Dependent Territory of Anguilla, and availing myself of the "unusual" legal services of one of the most prominent attorneys in that island, William Herbert, Jr., more commonly known locally as Billy. Dr. Herbert asked me whether any of my clients might be interested in purchasing a newly-unveiled product of neighboring St. Christopher & Nevis, a Citizenship by Investment passport, which came along with all the rights and privileges of citizenship. He would go on to disappear from the face of the earth after being falsely accused of losing or stealing a large amount of money belonging to the Irish Republican Army (IRA), but that's another story not relevant to our topic today (although you can find it here in previously published content on this blog).

t would appear that enterprising UK-trained Kittitian attorneys, when faced with the insufficient revenue needs of a newly-independent republic, and entrusted with creating a legislative solution to their country's cash-flow problem, took the Swiss model of bank secrecy, and added corporation secrecy to the equation. This means that companies could be formed with bearer shares, and criminal penalties were imposed for even making an inquiry about who was the beneficial owner of a corporation, with enhanced fines & imprisonment for law enforcement agent who dared to ask. It was an act which would insure that "flight capital" (dirty money) could be held in local accounts with total and complete anonymity.

I seriously considered taking Doctor Herbert up on his offer. One of my largest drug trafficking clients, the Parisian Georges Krancenblum, returned from a "business trip" to the Republic of Panama with a handful of passport photos appropriate to add to applications I intended to process for CBI passports, some of whom you would know, because they included certain kingpins in the feared Medellin Cartel. Unfortunately for the clients, one of their cocaine-laden vessels was seized shortly thereafter in the Miami River, and they were forced to flee the United States to avoid arrest and indictment.

When I advised Dr, Herbert that my clients most likely were now wanted by the DEA, and knowing that the Cartel leaders were most certainly indicted, his reply was that I somehow obtain an affidavit attesting to their good conduct, rather than letters from local police departments attesting to their lack of any pending criminal charges, which I could no longer do. At that point I understood the reality of the CBI passport scheme; it was purely a method to raise funds, and the fact that the applicants were criminals was not a factor in their approval. Those passport photos, and the unfiled applications promptly were shredded and dropped into my garbage can, which is most likely why I am alive today to tell this story.

|

| Ambassador Herbert |

Now, let's fast forward from 1983 to 2023, where the five East Caribbean states, and Malta, have sold CBI passports, knowingly, to career fraudsters, transnational narcotics kingpins, sanctions evaders, corrupt PEPs, and all sorts of Other Suspects, all for the sake of income into their national treasuries, plus cash bribe payments to facilitate the approval of such high-risk applicants, and the opening of large bank accounts there with the proceeds of crime. Their compliance programs, which are claimed to be effective, are routinely compromised by cash under the table, paid to corrupt government officials. Commission consultants, who rake in obscenely high payments for directing applicants to specific CBI jurisdictions, assist with the approval of clearly unsuitable applicants, and the madness goes on, and on, and on.

The money is far too powerful a corrupting influence for any of these programs to approach a Banking Best Practices compliance level, especially when the cash of these career criminals is promptly deposited in locally-owned financial institutions. It will not clean itself up, and compliance officers must face reality, and treat all the holders of CBI passports as extremely high risk, and bar them as gatekeepers, lest they involve their bank in willful blindness, with the usual negative consequences. Do you redline all CBI passports? Given what you have just read, do you really have a choice? This may hurt those legitimate CBI passport holders, but since you are operating a risk-based AML compliance program, you know the answer.

Monday, October 16, 2023

Friday, October 13, 2023

NEW ATTENTION TO CRYPTO TERRORIST FINANCING RECEIVED BY HAMAS FOCUSES ON PRO-PALESTINIAN ELEMENTS IN MALTA

Since the attack on Israel from Gaza, media covering terrorist financing have emphasized that the tens of millions of US Dollars and Euros transmitted to Hamas was a major factor in funding the Specially Designated Global Terrorist organization's extensive attacks, both using missiles as well as ground forces. Our sources have confirmed an increase in attention being given to the source countries where pro-Hamas and pro-Hezbollah elements have contributed substantial amounts of crypto to those terrorist groups.

One of the jurisdictions reportedly now specially targeted for attention to operational terrorist financing pipelines is the Republic of Malta, whose socialist government has long had diplomatic relations with the Palestinian Authority, and unofficially with Palestinian terrorist entities sanctioned by the West. The country's first Prime Minister, who held radical socialist views, and was close to the Communist dictatorships in power during his term in office. Malta has a substantial Arab expat community loyal to Hamas, which has long been suspected of terrorist financing, using crypto above all other items of value.

Longtime readers of this blog know that we have extensively covered the fact that both SUHA ARAFAT, the widow of Yasser, the ex-leader of the PA, and her daughter, live in Malta and have been given Maltese passports. They live an affluent life on a portion of the billions stolen by her late husband from EU funding intended for the Palestinian people.

While not covered in international media, there were recent arrests in Malta of terrorism suspects, although the country's law enforcement agencies have generally ignored the presence of individuals thought to be connected to international terrorism and terrorist financing. Whether this new investigative interest in the transfer of cryptocurrency to Hamas from sympathetic elements in Malta will result in any arrests, we cannot say, but we will be watching.

MAJOR MEDIA EXPOSES THE CLEAR AND PRESENT DANGERS POSED BY DOMINICA CITIZENSHIP BY INVESTMENT PASSPORTS TO THE FINANCIAL WORLD

If you have read the blockbuster article in the UK newspaper The Guardian this week, or the detailed analysis of the extraordinary dangers presented to the financial world by the OCCRP ( Organized Crime and Corruption Reporting), you know that not only are Dominica Citizenship by Investment (CBI/CIP) passports used by many of the world transnational financial criminals and sanctions evaders, from Russia, Iran, North Korea and other high-risk jurisdictions, but that there may be as many as 10,000 economic passports sold to dodgy clients, and not reported by Dominican government authorities. Dominica is out of control, when it comes to freely selling its passports to all comers.

Please note that the CBI industry has hastened to mount an extensive (and expensive) countermedia campaign, extolling the virtues of both the passports for legitimate investors seeking to conceal their high-risk, visa-requiring origins, and the purported due diligence ability of Dominica's government agency responsible for vetting the applicants. DO NOT believe this sophisticated PR move for a minute; Dominica economic passports, which recently lost their visa-free status in the United Kingdom, afget many instances of fraudsters, corrupt PEPs and other of the Usual Suspects using them to enter Europe, represent a danger to any bank which is foolish enough to accept them in its compliance department as evidence of low-risk status at account opening. It has become the favorite tool of financial criminals.

Therefore, as we have been warning for at least the past five years, compliance officers accept Dominica CBI passports at their peril. They often contain aliases, incorrect place of birth, and passport photos designed to defeat facial recognition technology. The holder is most likely someone you do not, and cannot allow to open an account at your bank, or conduct any transaction whatsoever, if you wish to protect your institution from exposure from money laundering and financial crime. Govern yourselves accordingly, ladies and gentlemen.

Tuesday, October 10, 2023

UPDATE: CAPTURED FOREIGN FIGHTERS OPERATING FOR HAMAS IN ISRAEL IDENTIFIED AS SUDANESE AFFILIATED WITH ISIS

IDF infantry have reportedly captured twenty foreign fighters after a clash inside Israel. These terrorists, who were involved in the atrocities against civilians, are not Palestinians; they are Sudanese soldiers formerly affiliated with ISIS. See our previous article; The Presence of Non-Palestinians among the Terrorists attacking Israel adds an Additional Dimension to Future Terrorist Financing Investigations (October 9, 2023).

It is not known whether they will be tried for war crimes, in a military court, or turned over to a court administered by the United Nations, as the protections of the Geneva Convention do not apply to individuals not in a national army, who are accused of War Crimes or Crimes Against Humanity. It is also possible that they will be extrajudicially executed, after reports of infants beheaded have surfaced. Much of the more grisly details of the murders have appeared on private videos made by eyewitnesses, but are not being aired by major media.

Monday, October 9, 2023

THE PRESENCE OF NON-PALESTINIANS AMONG THE TERRORISTS ATTACKING ISRAEL ADDS AN ADDITIONAL DIMENSION TO FUTURE TERRORIST FINANCING INVESTIGATIONS

|

| Hamas terrorist with hostage |

Alert observers inside Israel are reporting that a significant number of the terrorists have been seen, and photographed, committing war crimes inside Israel are NOT Palestinians. Their complexions, marking them as Africans, indicate that Hamas, and/or its sponsors and terrorist financiers, has recruited from outside the Palestinian Territories. This opens up an entirely new avenue for investigation, as foreign fighters they would have been paid handsomely, transported to Gaza, trained, and ordered to attack civilian targets, and take hostages. Financial records of such payments may provide valuable clues, allowing investigators to trace funding back to the point of origin.

Foreign fighters, most likely mercenaries, possibly from either Libya or Chad, and armed with specific intelligence of the residence addresses of off-duty IDF soldiers, particularly women, have taken a large number of hostages, committed sexual assault, and taken them to Gaza. Should any of these foreign mercenaries survive the expected upcoming IDF ground attack upon Gaza, their debriefing may supply clues about who or what supplied the funding for their service on behalf of Hamas.Whether national, tribal or regional leaders facilitated their availability will also certainly be a subject of inquiry when the dust settles on Gaza.

Initial payments to engage them, which would have been made in their country of origin, should be able to be tracked back. Iran's present lack of US Dollars in quantities sufficient to support Hamas would seem to rule it out as the source of funds. Was Qatar's funding of government employees diverted to finance this operation? We cannot say, but Western intelligence agencies will most likely earmark significant resources to determining who provided funding for this obviously extensively-planned terrorist operation.

Sunday, October 8, 2023

COMPLIANCE OFFICERS IN NORTH AMERICA CAN EXPECT INCREASED LAW ENFORCEMENT ACTIVITY ON TERRORIST FINANCING IN AFTERMATH OF ATTACK BY HAMAS

The widespread terrorist attack on Israel, conducted by Hamas agents against civilian and military targets in Israel yesterday, which can be judged a massive intelligence failure, will most likely have consequences for international banks in the United States and Canada. Hamas terrorist financing operations in the Western Hemisphere, which account for a large percentage of the income that the global terrorist organization receives annually, are expected to be a focal point for law enforcement agencies in North America, as a response to the pressure which is expected to be placed upon them for failure to detect indications of a terrorist attack of such magnitude.

While the international press has dwelled upon what it regards as an abject failure by Israel's intelligence community, it is important to understand that this inability to predict the outbreak of a major military operation by Hamas will also be seen as an American intelligence failure, and that will translate into pressure from US government leaders to order the suppression of existing Hamas financial pipelines, whereby it funnels the proceeds of its Western Hemisphere income-producing crimes to the Middle East.

It is also important that compliance officers understand that the leadership of our law enforcement agencies tasked with the will be anxious to demonstrate the effectiveness of their counter-terrorist financing capability, by targeting any financial institution or NBFI found to have been facilitating any payments that ultimately ended up in Hamas' coffers. We may not like it, but political pressure will play a significant role in such ramped-up investigative action, and any banks found to be involved will end up as the likely targets of those agencies. Law enforcement will be in a mood to redeem itself, and there will be casualties in the financial world among those found to have been negligent. Call it a knee-jerk reaction, and understand that it is coming.

The leaders of compliance departments, who are responsible for CTF suppression at their banks should be sensitive to this, and it is suggested that their staff take a hard look, now, at any major transactions that ended up in the Middle East, to rule out the possibility that terrorist funding to Hamas transited their bank, rather than learn about it later, publicly, through the negative publicity that results from law enforcement and regulatory exposure of activity not uncovered initially by the bank's compliance officers.

Saturday, October 7, 2023

BILLION DOLLAR CASE FOCUSES ATTENTION ON THE USE OF FAMILY OFFICES FOR MONEY LAUNDERING

This week's $2.4bn asset seizure case in Singapore, involving the arrest of several Chinese nationals in an organized crime money laundering investigation, has drawn attention to the use, by laundrymen, of family offices in their illicit operations. Singapore, which has over 1000 family offices maintaining their principal place of business there, in an effort to increase the attractiveness of the jurisdiction to financial firms, until recently had minimal disclosure requirements for such entities. The favorable treatment included no taxes levied upon Capital Gains. Remember the Law of Unintended Consequences?

Apparently, the government failed to recognize that such a situation was a magnet for money laundering. reports from Singapore indicate an estimated $1.5tr (yes, that's trillion dollars) has flowed into the country in response to the lack of financial regulation of family offices. Money launderers are constantly looking for what we call Targets of Opportunity, situations where the facts permit penetration of the legitimate financial structure by enterprising and imaginative laundrymen, who use financial flaws to practice their illicit profession.

While we are on the subject, if you are a compliance officer at a financial institution that numbers family offices among its client base, have you insured that Source of Funds and Source of Wealth in their large accounts has been examined? Money Launderers are often sophisticated attorneys who are able to artfully construct what appears to be a legitimate entity, working to handle multiple wealthy clients at the same time, when in truth and in fact the entire enterprise is a front for cleaning the proceeds of financial crime. Are their clientele truly whom the family offices says they are? While there is no history of family offices being used as money laundering fronts, given this Singapore case, can you really be sure that all your family office bank clients are clean, unless you take a hard look at them?

Friday, October 6, 2023

LESSONS FROM A FORMER MONEY LAUNDERER; ADOPTING A CRIMINAL'S MINDSET TO SAFEGUARD YOUR BUSINESS AND MINIMIZE RISK

GOING TO MONEY 20/20?

To effectively safeguard your business against risk, it is essential to adopt the mindset of a nefarious actor. Explore the intricate realm of financial crime through the eyes of Kenneth Rijock, a former money launderer for a number of American and European narcotics traffickers.

This informative session will reveal the shadowy world of financial crime, and empower your organization to confidently fight back through radically accurate identity verification and fraud prevention solutions.

WHERE: Money 20/20 Las Vegas, October 23, 2023. 12-2 PM. Lunch will be served. LOCATION: Trustworthy Brewing Co. SPONSOR: Socure

Thursday, October 5, 2023

SINGAPORE WAKES UP TO THE USE OF LUXURY HANDBAGS AS TOOLS AND IMPLEMENTS OF MONEY LAUNDERERS AFTER $2bn SEIZURE FROM CHINESE NATIONALS WITH DOMINICA CBI PASSPORTS

If you have event spent five or six figures on an ultra-luxury handbag at Hermes, you know the value of those items, which have a special place in the hearts of many fashion-conscious women around the world. Also, if you have ever seen throngs of poorly dressed Chinese nationals, outside luxury goods stores in the principal cities of the world, you know those people are buying for resale, most likely as proxies, for they could not afford the prices of their purchases. The Hermes Himalayan Crocodile Birkin, shown above, is for sale this week on the Internet for $295,000. Does that get your attention as a potential instrument of laundrymen?

Luxury goods, which can easily transit international frontiers, and move value across borders without declaring their actual worth, remain useful money laundering tools, for international transit without the risk of bulk cash smuggling. Recently, several Chinese nationals were exposed by the authorities in Singapore for operating a billion dollar international money laundering ring. More than two billion dollars, in cash, financial instruments and personal property, was seized to date.

Of course, super-expensive handbags were also seized. as the direct and proximate result of this, the Government of Singapore has announced that it will hereafter regard such items as evidence of possible use in money laundering activity. Given their expense, it is a sort of backdoor Unexplained Wealth technique. Readers who are addicted to Hermes, and own one or more, may want to leave them at home when engaged in international travel, for Singapore's actions will most certainly catch the attention of law enforcement abroad.

A final note: all of the accused Chinese laundrymen had Dominica Citizenship by Investment (CBI/CIP) passports, of they thought that such criminal activity is no longer being facilitated in the Commonwealth of Dominica. It's as bas there, regarding sales to career criminals, as it ever was.