|

| OBSOLETE ? |

If I am the typical compliance officer at a bank located in the United States and Canada, I may be woefully behind the times, when it comes to banking best practices, for I am neither using facial recognition software, nor social media resources, when it comes to effective customer identification. Here's why this is important in 2020.

The march of modern technology, and economics, have made it much easier for transnational criminals to obtain, and employ, official identification documents under aliases that your CIP database searches cannot detect as bogus.

(1) Corrupt government officials, often drawing very small salaries, facilitate white-collar crime by creating passports under aliases, and then ensuring that any subsequent inquiries or searches will not uncover any red flags which lead compliance officers to question them.

(2) The plethora of Citizenship by Investment (CBI/CIP) programs has resulted in an explosion of valid passports, many of which are either under aliases, or transliterated spellings, and do not identify the holders by their true legal names. Moreover, many CBI jurisdictions supply birth certificates, drivers' licenses, even utility bills or deeds to real property, which give a complete, albeit totally false, sense of security to compliance officers requesting the,

(3) Technology has advanced to the point where forgers and makers of false identity documents, employing inside information or proprietary programs stolen from Government sources, can create a close to 100% foolproof, undetectable document.

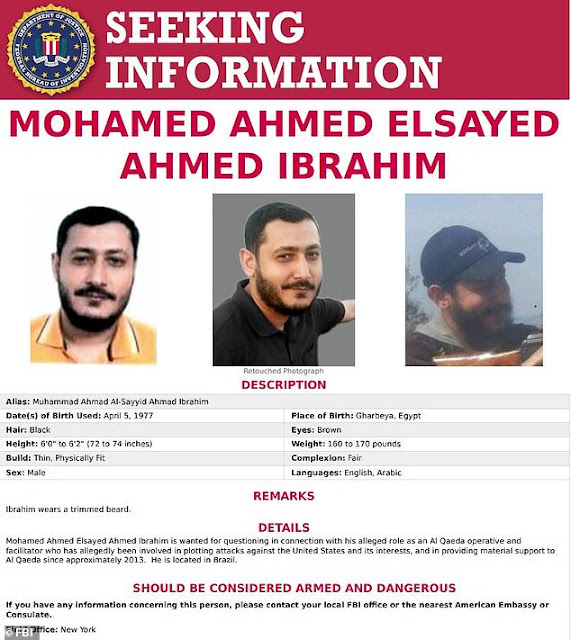

Therefore, facial recognition platforms, the best of which have access to passport-picture quality image libraries, must be deployed to positively identify your subject. You will not find your subject's alias in any commercial off-the-shelf database of high-risk individuals. Only through facial recognition technology do you have a good chance of making correct identification, yet most compliance officers in the US and Canada are not there yet. Let us hope they are beginning to understand that money launderers and financial criminals can now gain easy entry to their banks, unless they abandon their current CIP methods, and move to facial recognition.

Additionally, as a supplemental tool, the use of specific software programs that search social media and socialnetworking sites are extremely useful, when compliance wants to rule out criminal associations, undisclosed PEP status, or other potentially negative facts about their targets. Social media programs often reveal something that the client wants to conceal, which may affect risk levels or suitability for onboarding altogether. It is a recommended component of your CIP toolbox, to rule out any nasty surprises after the client has been approved at account opening

Some experienced compliance officers have gone even further, believing that only through post-account opening transaction monitoring can a new client's risk profile be accurately measured, but for the majority, I would humbly suggest facial recognition tools be deployed at this time, with social media/social networking resource software also available to frontline compliance officers performing Customer Identification.