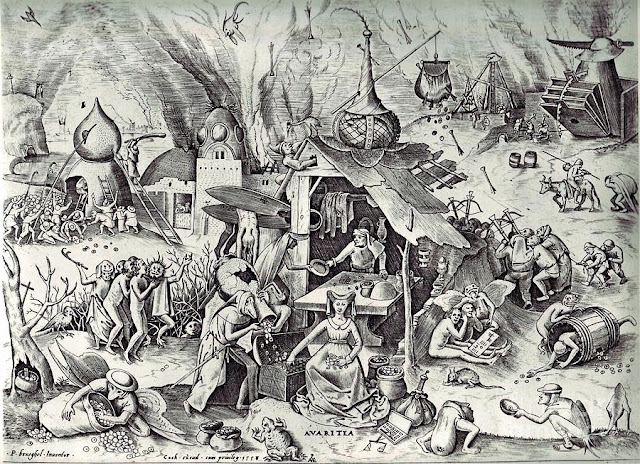

The Seven Deadly Sins by Pieter Bruegel

A number of commentators in Malta have been displaying the names of JOSEPH MUSCAT, and his associates, individuals who can only be labeled sinners. Perhaps it's high time that their specific transgressions are listed in Biblical terms.

PRIDE; LUST; GREED; ENVY; SLOTH, WRATH; and GLUTTONY.

The Travel Ban imposed by the United States State Department is the first in history against citizens of a European Union Member and friendly state. Muscat, his extended family, and his former Cabinet, risk possible extradition if they travel to the EU or UK. They may end up marooned on Malta, due to well-placed fears of possible arrest and extradition upon arrival at a foreign destination that they thought was safe.

We warned you on this blog, during the past three years, that there would be consequences for violations of the Foreign Corrupt Practices Act (FCPA), but the commentators all said the US would take no action. They also discounted the articles about three Cooperating Individuals, who come from the Labour Party, and who have reportedly given evidence against Muscat, Mizzi and Schembri, to American law enforcement agencies. Our warnings have become reality, and this is just the beginning.

It is widely known that Joseph Muscat paid high-priced American criminal defence attorneys fees in excess of $100,000, to obtain information confirming that he is not the subject of a pending indictment in the United States. That is incorrect, and any lawyer who has told you he can determine, with 100% accuracy, that you are not under indictment, has hustled you, Mr. Muscat. You are the Number One target.

One additional issue facing Muscat: he may now be ineligible to travel on any airline in Europe. Commercial aviation uses their US Dollar accounts to purchase fuel and parts, and for aircraft leasing. They apparently fear American sanctions if they accept payment from Muscat, his wife, and even his designer-clad children, given the broad scope of the State Department sanctions.

If Malta doesn't immediately begin to clean up the rampant corruption and money laundering, through its presently inept court system, things will surely get worse. One look at the blunt threats currently being made against Russia and Belarus by the United States should concern every Maltese businessman, because an angry America can impose those sanctions upon their country; being cut off from the American financial structure, or the SWIFT wire transfer network. Either of these actions would cause chaos within the Maltese financial system, most likely followed by panic among the population, and domestic instability.

Both the EU and the United States are waiting for Malta to respond with a comprehensive anti-corruption programme; in the absence of it being implemented forthwith, you can expect Malta to soon experience even most drastic measures, which can only result in the slow death of the economy.

Will the last person leaving Malta remember to turn out the lights ?

Romans 6.23, Ladies and Gentlemen.

|

| Signpost near Castille |